Prepping for my trip to California next week. I am headed to NorCal to visit some companies and clients and then to SoCal to attend the LA Auto show. The media schedule was just published and there doesn’t seem to be too many exciting unveils this year with the exception of the Lucid Gravity.

As for Lucid, their share price tanked recently due to their Q3 earnings and sales miss. They reduced their sales forecast for 2023 to ~8.5K, and that’s for the WHOLE YEAR. Lucid has challenges. Price, product and manufacturing just to name a few off the top of my head.

Price = too expensive. Product = Only one product. Manufacturing = They produce enough of them.

Now, all these things combine to create a very dysfunctional company. Producing at scale would alleviate many issues but they can’t do that yet because they don’t know how to. Reducing the price would likely add incremental demand which at this point in time would gum up their manufacturing even worse. Adding a product would double the complexity of manufacturing which would also gum up their manufacturing even worse.

So Lucid has challenges but as Elon so eloquently put it, Lucid (and Rivian for that matter) are going through manufacturing ‘hell.’ Its lasted much longer than I’d anticipated for both. I don’t really see any chance that either goes out of business but those advantages both had from entering the market early have all but evaporated.

Competition in the next 24-30 months will dial up the heat on management even further. Unless they can somehow figure out how to build EVs. Now do you see why Apple hasn’t thrown their hat in THAT ring yet?

CHINA EVs & MORE (CEM)

Back to our normally scheduled programming – 9am ET on Friday. Join us if you’re free.

If you’d like to join the live show, follow me on X: @sinoautoinsight and at 9am at the top where the Spaces rooms show up, you should see our show. It’s an opportunity to ask any questions and have discussions with Lei and I so if are itching to know more about something, join us tomorrow morning!

If you can can’t join the live show, I invite you to listen to our recorded China EVs & More episodes at this site. And as always, we appreciate any feedback that will make the show better.

BIGGEST NEWS OF THE WEEK

-

Top Brands & Models in China for the month of October, which is normally a slower month due to the holidays at the beginning of the month. These aren’t just for just NEVs, this is the entire market including ICE vehicles BTW. Dominated by Chinese brands, one brand in particular. They are running away with it.

GET SMARTER

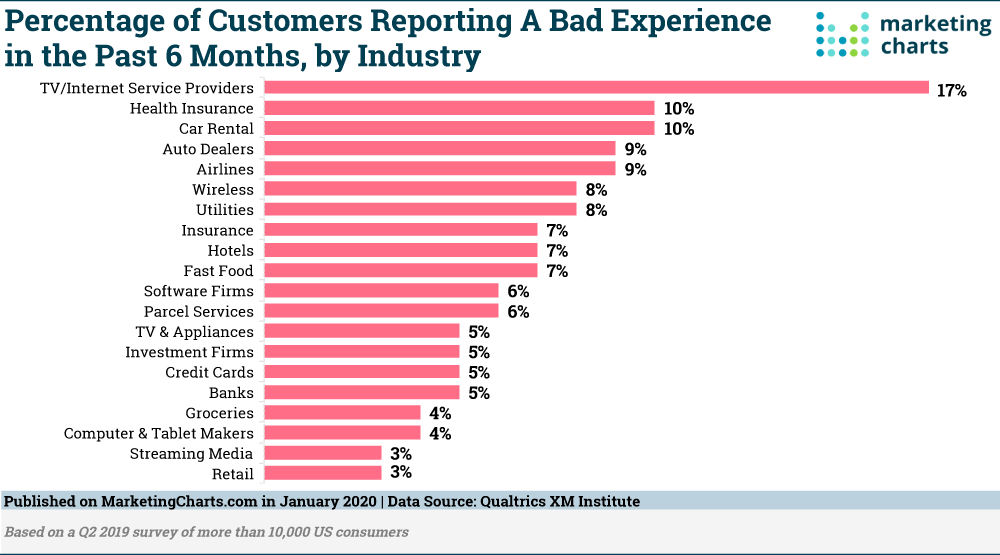

Dealers will NOT be advocates for EVs. What is the 4

rd most exasperating sales experience in the US? You guessed it, car buying. The first two are effectively monopolies so that leaves car rental and car buying. That’s not coincidental.

There are over 16K dealerships in the US according to the WaPo article which means that a disproportionate amount of dealers give terrible customer service, and this was before the EV transition. For my entire adult life, the car buying experience has been dreadful. For those that have read this newsletter for any length of time, you all know that I think the US system of buy / sell cars through dealers should be blown up and really handed back to the OEMs.

The market has evolved. We don’t need salespeople to explain anything to us anymore since most of what we want to know can be found on the internet in an objective manner. This is not about my disdain for dealers and the fact that they are totally anti-competition, but if you’re an OEM and your biggest competitor can keep its margins while providing a better customer experience you’re at a total disadvantage.

On top of that, now that selling digital services are becoming a part of your future revenue forecasts isn’t owning that direct relationship with your consumer key to being able to make those sales? If you think about it, the legacy automaker in the US has NEVER had real, direct contact with their customer since it’s always been through the dealer.

They need to wrestle that back, otherwise they will lose the sale and it won’t be to their crosstown rival who has a similar vehicle in stock at a cheaper price. It’ll be because they had a pleasant customer experience – which will also ingratiate that consumer to being loyal.

The OEMs only have ONE chance to get this right so I’d fight like hell to make sure that any potential customers that want to buy my EV deals only with me directly. Not some person who isn’t incentivized properly to highlight the virtues of said product.

-

Two-wheeled motion – electrified. Back in the early days of this newsletter, especially when I was sitting in Beijing writing it I used to be all about more than just 4 wheel EVs and passenger vehicles. One area I always tried to highlight was the innovation and electrification happening on two wheels in Southeast Asia and South Asia. This Bllomberg interview points to the revolution on two wheels happening on the other side of the world that’s not as glamorous or as politically charged but AMAZING nonetheless.

It's a story that starts with companies like Niu, Evoke and Gogoro and continues with companies like Ola Electric. You may think the Europeans use motorbikes to get around their cities, but in places like Taipei, Bangkok, Kuala Lumpur, Hanoi and Mumbai, motorbikes are family cars. It’s unique to Asia and it’s something that has to be seen to be believed.

The pollution in some of those places is such that converting to clean energy is a governmental imperative hence the startups that have popped up to accommodate the demand. But my fond memories of those places are all about the busy-ness of the streets in those cities and having to weave in and out of the way of those motorbikes in order to get to my next destination.

As someone who always felt a rush when sitting on a small, plastic chair on a corner in District 2 or 7 of Saigon, I was born in Saigon not Ho Chi Minh City so It’ll always be Saigon for me, smelling the exhaust from all the gas powered motorbikes sipping on a bia hơi (normally with a big piece of ice in it) slurping an amazing bowl of pho.

My recommendation is for those explorer / travelers out there that have not yet had that experience, book your tickets soon. Electric motorbikes have gone down in price so much so that within the next 10 years, those scenes unfortunately will not exist any more.

I appreciate progress and the people in those regions deserve the same conveniences that we have, but sometimes progress comes at the cost of culture and experience. I’ll be right back, I need to look at my calendar to see when I’ll be headed there next!

-

You thought the Cariad debacle was a one off? You’d be wrong. Most people in the traditional auto sector I think would tell you that Toyota is one of the best managed companies in the world, even when comparing them to non-automotive OEMs. That’s why this WSJ article is so interesting and helps hammer home my thoughts about the ENORMOUS challenges still ahead of legacy auto.

I’ve highlighted for the last few years all the stumbles of VW Group with their software division Cariad. This article does the same, except the you swap in Toyota with their version of Cariad being Woven Planet.

I was always a bit confused what Woven Planet did. Admittedly, I didn’t dig too deep or ask too many people to get that answer but it now seems that even the Woven Planet employees were a bit confused about what they do.

This article is worth the read for those interested in the gory details of the Woven Planet mess. In summary, this is more about legacy auto learning how to do software. It’s about legacy auto being able to abandon their past culture and processes in order to quickly incorporate what’s likely the most important skill needed in the future of mobility.

I believe most of them can’t do that with the current management teams. They don’t need to clean house but they can’t keep their entire, same teams intact either. Speed is of the essence, which unfortunately isn’t an essence that legacy auto has ever had.

BYD

-

The (BYD) Fang Cheng Bao Bao 5. It’s the first offering from one of BYD’s newest offroad brands that hits just above the BYD and Denza brands, so not quite premium but not not premium. A boxy midsize SUV the likes of the LR Defender and Merc G500 that’s priced around $40K should deliver a TON of value to Chinese consumers and should undoubtedly find many new homes when it begins delivery before the end of this month.

TESLA

-

Tesla’s fresh MIC MY refresh gets more expensive. It was the performance version of their MY a few weeks back but now it’s both the long range M3 & MY. It looks like even Tesla is ready to say ‘No Mas’ on the price war and are trying to claw back some margin, using the ‘rising costs’ excuse.

BY THE NUMBERS

-

105K. That’s how many EREVs Li Auto sold in Q3’23. A record. They sold 26K a year ago. Record revenues, profits and margins that beat it’s US traded brethren. Li Auto is firing on ALL electrons and cylinders.

-

41%. Total vehicles: 1,132. NEVs: 469. That’s the percentage of vehicles on display that will be NEVs at the Guangzhou Auto Show that kicks off on November 17

th, the same day of the LA Auto show media day (technically a day later but the same day time wise).

As the US & EU develop hiccups on the way to a clean energy vehicle future, the most important NEV market in the world keeps rolling.

This weekly newsletter is a collection of articles we feel best reflect the happenings of the week or important trends that have effects on the global automotive and mobility sectors. We also provide a point of view that we hope educates and sparks debate.